Steel Industry Outlook 2026: Stable Demand, Structural Optimization, and Quality-Driven Growth

In 2026, the global steel industry continues its transition toward more stable and sustainable development after several years of cyclical adjustment. Supported by infrastructure investment, gradual manufacturing recovery, and steady demand from emerging markets, the steel market is shifting its focus from volume-driven expansion to quality-oriented growth.

Stable Global Steel Demand

Infrastructure and construction remain the primary drivers of steel consumption in 2026. In emerging regions such as Africa, the Middle East, and parts of Asia, ongoing urbanization and investment in transportation, housing, and industrial facilities continue to support demand for steel rebar, steel plates, and structural steel. Public infrastructure projects and private construction activity provide long-term demand stability.

Differentiated Demand Across Steel Products

The steel rebar market remains closely tied to construction and civil engineering projects, while demand for steel plates and steel coils is increasingly influenced by manufacturing, energy, and equipment sectors. Products with higher strength, improved durability, and better corrosion resistance are gaining market share as buyers prioritize performance and lifecycle cost efficiency.

Raw Material Prices and Cost Control

Prices of key raw materials such as iron ore and coking coal are expected to remain relatively stable in 2026. This price rationalization helps steel producers improve cost control and maintain more predictable pricing strategies, particularly for export-oriented manufacturers serving international markets.

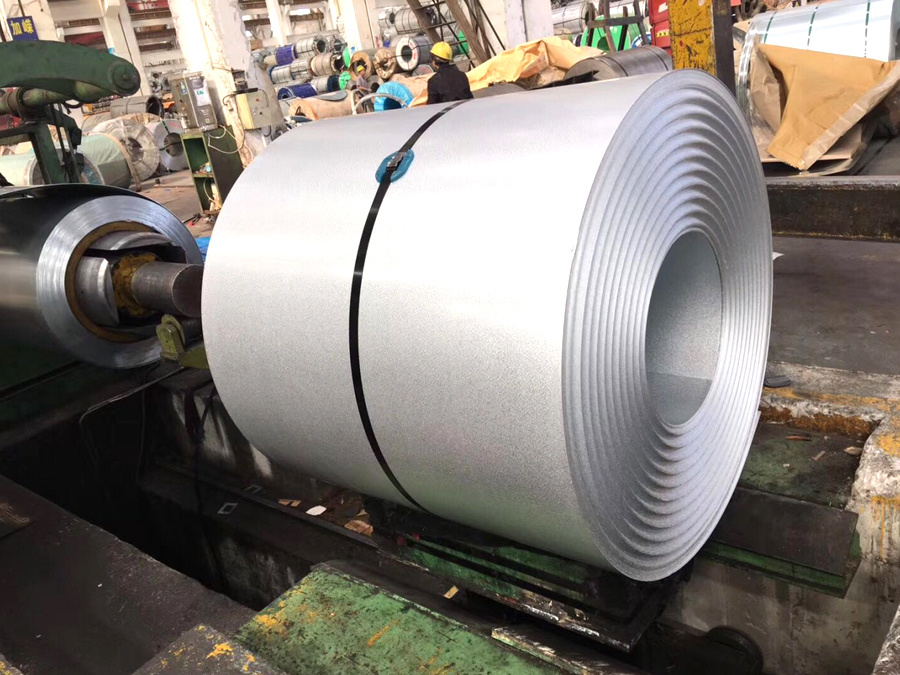

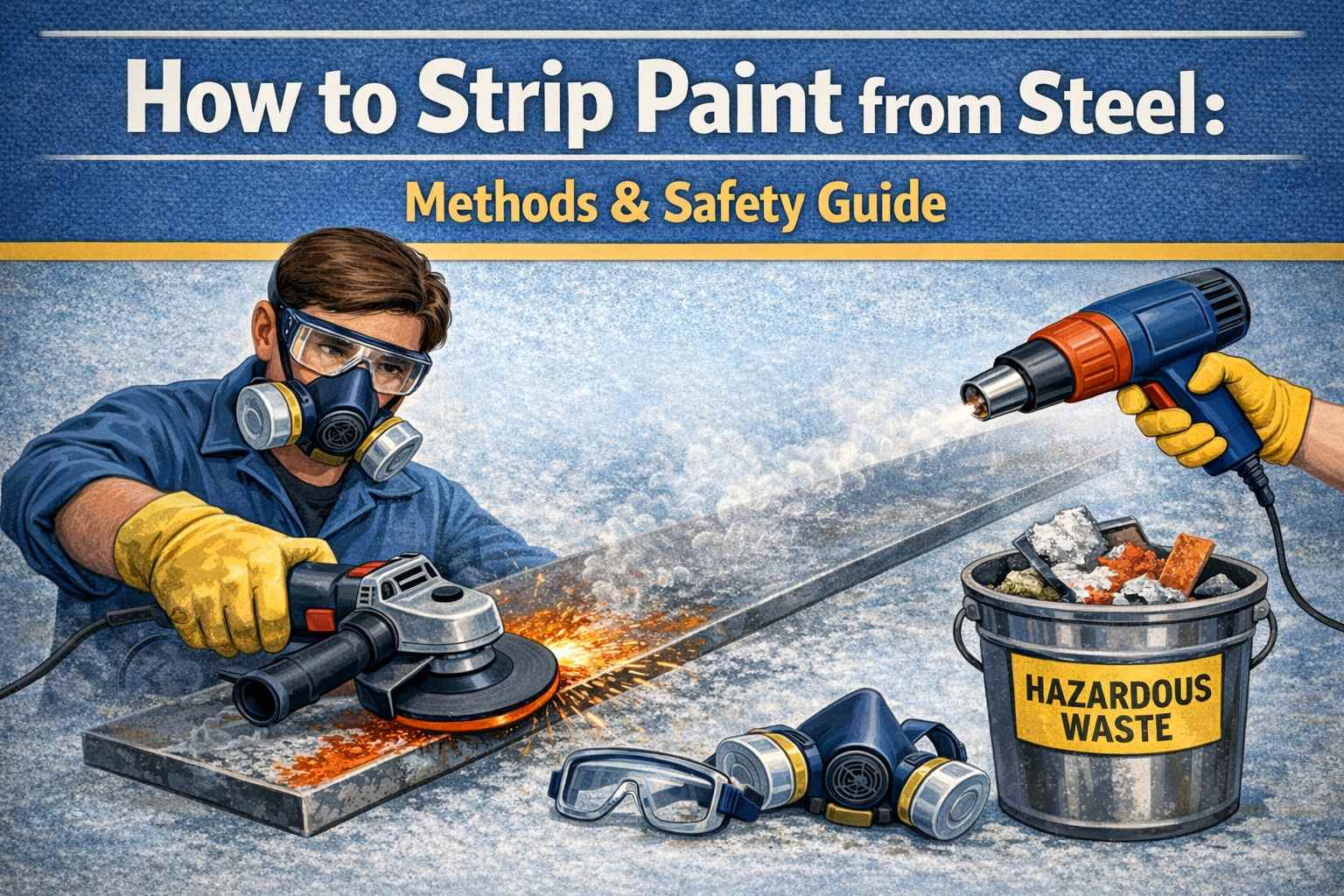

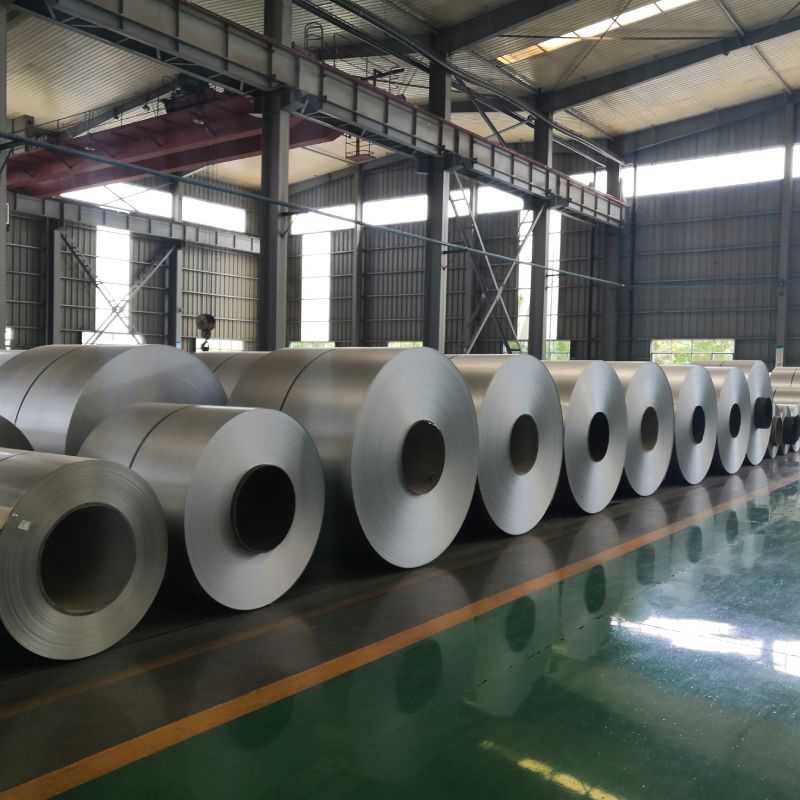

Product Upgrading and Value-Added Focus

Steel producers are accelerating the development of higher value-added products, including high-strength rebar, galvanized steel sheets (GI), galvalume steel sheets (GL), and pre-painted galvanized steel coils (PPGI). Improved production technology, stricter quality control, and customized specifications are becoming essential competitive advantages.

Sustainability and Low-Carbon Transition

Environmental regulations and global carbon reduction targets continue to influence the steel industry in 2026. Steelmakers are investing in energy-efficient production processes, cleaner technologies, and resource optimization to reduce emissions and enhance environmental compliance, which is increasingly important for international buyers.

Global Trade and Market Opportunities

Despite ongoing trade policies and regional uncertainties, global steel trade remains active. Suppliers with stable production capacity, consistent quality, flexible payment terms, and reliable delivery are better positioned to capture opportunities in international markets.

Overall, the steel industry in 2026 is characterized by steady demand, structural upgrading, and increasing emphasis on quality, sustainability, and service capability—setting the foundation for long-term, sustainable growth.